Australia’s beer bosses have given the Carlton and United Breweries sale the thumbs up.

Announced late on Friday afternoon, the $16billion deal sees Asahi become the new owner of CUB. The acquisition makes Asahi Australia’s biggest brewer. It’s also a return to the fold for the Japanese brewer, which held a stake in Foster’s during the 1990s.

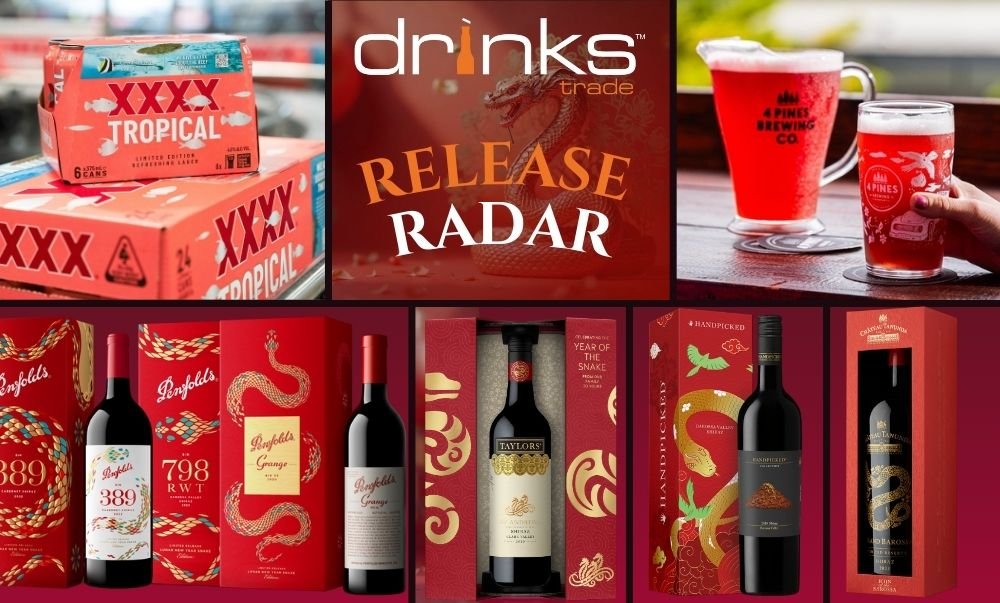

Japanese companies now own both of Australia's major brewers. Kirin purchased Lion, brewer of XXXX and Toohey's, in 2009.

CUB chief executive Peter Filipovic (pictured above with the Four Pines team) said he was “very excited to be joining Asahi”.

“We are a great Australian business, with iconic brands, world-class breweries and great people,” he noted.

“These have made us the market leader in Australia and we look forward to growing the business and the beer category with Asahi.”

"This is an exciting proposition for our business, and will support our vision to be the first choice in beverages," said Peter Margin, executive chairman of Asahi Beverages.

Coopers Brewery managing director Tim Cooper told the AFR he welcomed the sale as his brewery had “been under pressure due to strong CUB sales tactics”.

“We think that it will be good for the beer market in Australia in the sense that Asahi will most likely provide more stability for CUB," Cooper said.

“Asahi, I believe, will take a longer-term view of the market and that should hopefully help us grow the whole beer market, because we have faced a decline since 2009 when the whole beer market was 1870 million litres and we’re down below 1700 million litres."

Cooper said CUB had stepped up its hard marketing tactics in the lead-up to the Asahi buyout, evidenced by Coopers sales volumes dropping 11% last month.

The Carlton and United sale is expected to be finalised by the first quarter of 2020 and follows a $1.4billion previous Aussie buy ups by Asahi, including Independent Liquor, private label bottler P&N Beverages and a water bottling business that includes brand Mountain H2o.

Margin said it was too early to say if the Carlton and United Breweries sale would provide opportunities for synergies with its Schweppes soft drink business, which it acquired 11 years ago for more than $1.2 billion.

Following the takeover, Asahi will control half of the Australian beer market. The ACCC, Australia’s competition authority, will hold a public review into the sale once a submission is received.

Share the content