The South Australian government says that demand for exports from the state continue to rise, as trade ties with the state’s biggest export market – China – pick back up after months of decline and increases in its second and third largest markets, the United States and Malaysia.

The value of wine exports – SA’s third biggest commodity (up 5 per cent to $1.3 billion) – swung around to growth after boosts in other markets including the US, Canada, Malaysia and Thailand.

South Australian exports across all industries hit $15.9 billion in the 12 months to November 2022, up 22 per cent on the previous year thanks to strong prices, good seasons and reduced global supply. Growth in the US was up 38 per cent to $1.5 billion and Malaysia up 35 per cent to $1.3 billion thanks largely to refined metals, wine and meat.

South Australian Minister for Trade and Investment, Nick Champion, said "We want to keep building trade ties with our biggest export partner while tapping into new and emerging markets."

However, the gains in the exports of South Australian wine are not reflected nationally. Last year's annual report from Wine Australia reported that Australian wine exports had declined by 1 per cent in volume to 627 million litres and 11 per cent in value to $2.01 billion in the year ended 30 September 2022.

This has left Australia with an oversupply of wine, mostly red, and an industry looking to leave many of its grapes on vines this vintage.

John Geber (pictured right), owner of Château Tanunda, said, "Growers and winemakers are certainly reacting ahead of vintage, with some determined to go light in terms of make for 2023. With excess stock holdings from the past two vintages on top of grape prices suffering up to 30 per cent, it makes sense."

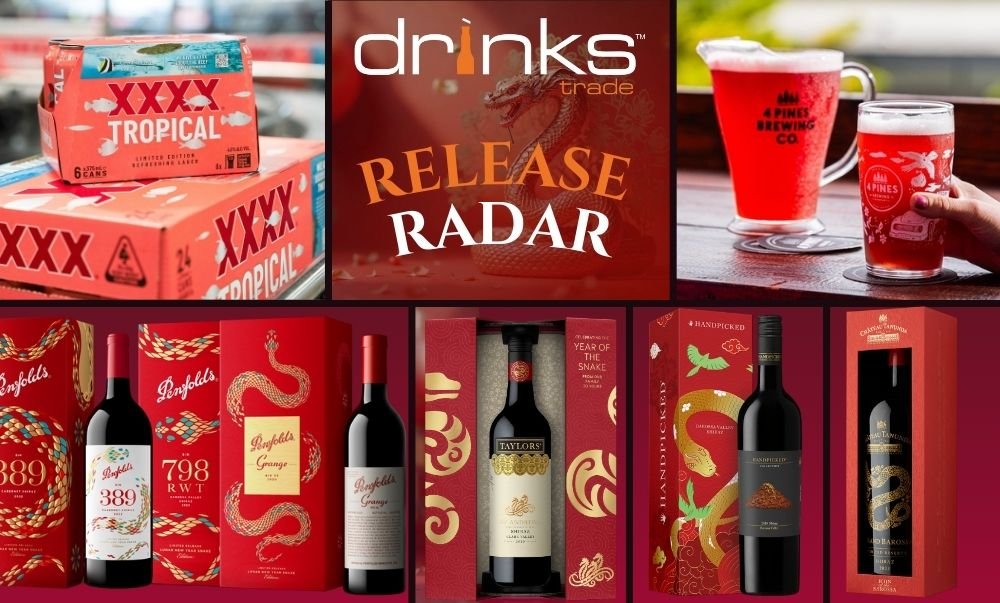

While trade with China remains stalled, there is cautious optimism among some winemakers that the tide is slowly turning. In Canberra earlier this month, China's Ambassador to Australia, Xiao Qian, toasted a warming relationship with Australia with a glass of Château Tanunda Shiraz.

Geber said, "The challenge is everything could change tomorrow. The 'Year of the Rabbit' is upon us - which brings prospects of good fortunes, hope and calm. I fear if we don't make enough stock from the 2023 vintage, we will find ourselves in a difficult supply situation in 2024 if there is a resetting of the agenda."

Ciatti Global Market reports that Australian bulk prices for red wine grapes have fallen by over 50 per cent from AUD$1.50 per litre in October 2020 to AUD$0.70 per litre in October 2022 for Shiraz, Cabernet Sauvignon and Merlot. White wine prices have also started to decline with high input costs and extreme inflationary pressure on global shipping rates only adding to winemakers' woes.

In South Australia's Riverland, flooding has compounded these issues such that the state government is granting $100,000 to Riverland Wine for the development of a 10-year industry blueprint. Riverland Wine will contribute a further $50,000 of its own funds.

The blueprint will identify strategic priorities for the entire region’s wine industry to help it recover from some of the most challenging years in decades and improve productivity.

Minister for Primary Industries and Regional Development, Clare Scriven, said: "The Riverland along with the Murraylands, is home to over 60 per cent of the State's wine grape production and is the largest wine region, by volume, in Australia. Now, undoubtedly, this vital region is facing one of its toughest periods in living memory.

"The blueprint will serve to bring all participants in the Riverland wine supply chain to work together, ensuring it is again a sustainable and thriving industry."

Share the content