IWSR’s innovation tracking data shows new RTD products are increasingly driven by sustainability and premiumisation cues, including super-premium pricing, packaging with less plastic, fewer direct health claims and greater diversity of alcohol content.

Key RTD markets – Australia, Brazil, Canada, China, Germany, Japan, Mexico, South Africa, the UK and the US, reflect this trend representing 85% of global RTD consumption.

"The ability to respond to consumer needs goes some way to explaining the rapid rise of RTDs," says Brandy Rand, COO Americas at IWSR. "The category is growing quickly in countries like China, Canada and the US, the world's largest RTD market."

The number of RTD products using plastic-only packaging is reducing. IWSR data shows that just 1% of new RTD products used plastic-only packaging in the second half of 2021, down from 5% in the year's first half.

Environmentally-focused packaging cues are increasingly important to consumers. For example, IWSR research shows that 44% of alcohol drinkers in the US feel businesses with an active environmental or sustainability agenda positively influence their purchasing decisions. Some markets are moving away from plastic more quickly than others. In Germany, Japan and South Africa, no new products used plastic alone last year. On the other hand, Brazil and Mexico are progressing away from plastic but still have some way to go.

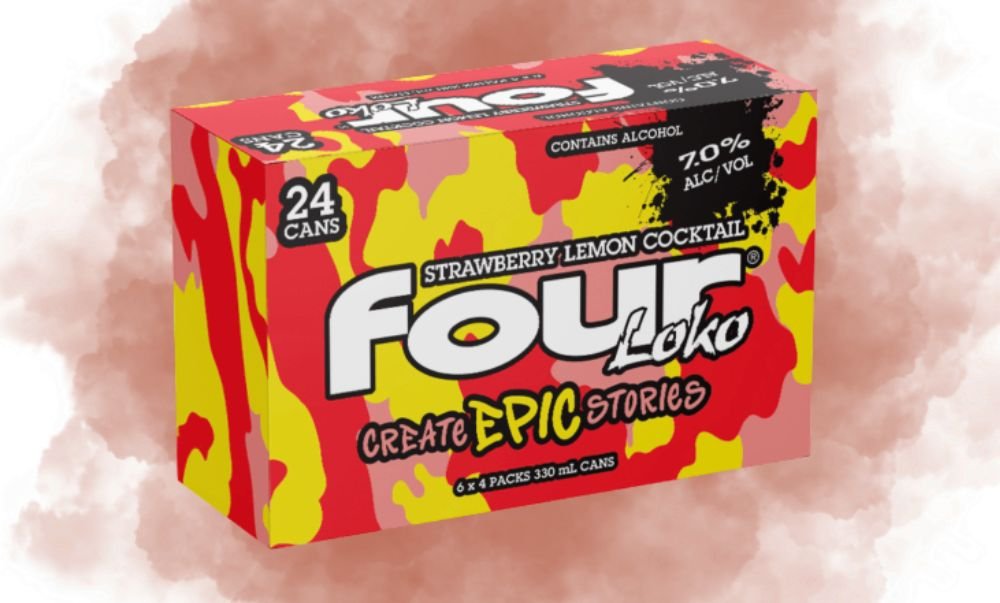

IWSR has been tracking an evolution in flavour profiles for RTD products, especially for spirit-based RTDs in the US, with two distinct flavour profiles coming to market. IWSR has defined these as “complex” and “simple” flavour products.

"Complex flavour" drinks contain full sugar, calories, and ingredients. They provide the full-flavour taste profile of an alcoholic beverage and tend not to be carbonated.

“Simple flavour" drinks have lower sugar and calorie contents. They tend to be lighter and clear, based on seltzer or soda and are generally more refreshing.

However, the two groups aren't entirely distinctive and already show some overlap. For example, Spa Girl cocktails are low in sugar and carbs, but at 11.5-16.5% ABV, they contain 3.4 times more alcohol per serving than the average spirit-based RTD.

As an extension of evolving flavours, new RTD brand owners and established producers are increasingly introducing products with higher ABV rather than focusing on the more traditional 3-5% range. Around half of all new RTDs launched in the second half of 2021 had an alcohol content of 5% or higher. This trend has been led by China, the US, and Australia but is not universal. Countries such as Germany and Japan are seeing fewer innovations with higher ABVs.

Share the content