The deal may face few regulatory hurdles in Australia, but John Colley, Professor of Practice at UK’s Warwick Business School, this week reaffirmed that it is a different story in the US and other markets.

AB InBev on Wednesday requested a further one-week extension from the UK Takeover Panel to announce its firm intention to make an offer to acquire SABMiller, bringing the deadline to November 11.

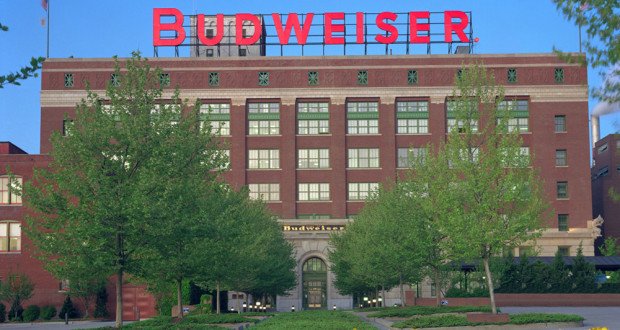

The Budweiser owner claimed it and SABMiller had “made good progress” in agreeing terms, but Colley suggested the delay was telling.

“Whilst SABMiller has indicated they will accept the $106 billion bid it clearly depends on whether AB InBev can sell its Miller Coors stake in the US at an acceptable price in what is effectively a forced sale,” the Professor said.

"The sale almost certainly will be required by competition authorities as AB InBev's post bid market share of the U.S. beer market will exceed 70 per cent.”

Colley said Molson Coors holds the cards in having the rights to first and last bid for AB InBev’s stake in Miller Coors.

“AB InBev need a deal before the SABMiller bid becomes final. Available time is too short to hawk it around,” he said.

“Hence AB InBev have a very short time window to negotiate as they can at least threaten Molson Coors with pulling the entire bid for SABMiller.

“Molson Coors will never have a better opportunity to pick up full ownership at a reasonable price,” Colley said.

He said Molson Coors is the major obstacle to progress with the SABMiller bid, but a post bid market share exceeding 40 per cent in China will also attract the attention of competition authorities and may require disposal.

"Similar situations will arise in parts of Europe and Latin America and may also require disposals effectively through forced sales. These are all value lost from the proposed merger. China and the U.S. alone make up almost one third of SABMiller,” the Professor said.

"At what point do these forced sales make the SABMiller bid value destroying? Research tells us that historically 60 to 80 per cent of acquisitions materially fail to deliver expected benefits and over half destroy value."

Share the content