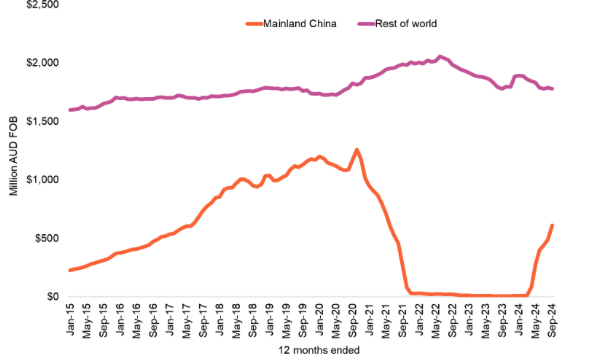

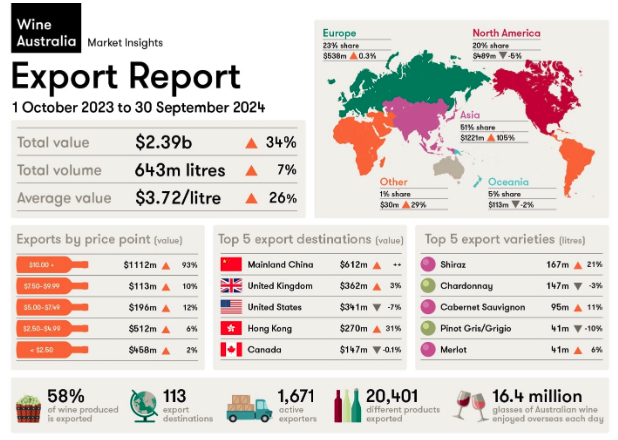

According to Wine Australia’s Export Report, Australian wine exports are currently at their highest levels of both volume and value since August 2021. In the year up to September 2024, exports of Australian wine grew 34% in value to a worth of $2.39 billion and 7% in volume to 643 million litres. This was largely driven by the reopening of the Chinese market, with shipments to mainland China increasing from $604 million to $612 million in value and from one million litres to 59 million litres in volume.

By comparison, the UK and the US - Australia’s second and third most important export destinations by value - totalled $703 million together.

Wine Australia’s Manager of Market Insights Peter Bailey warns that the growth of wine exports into China are unlikely to resolve Australia’s current oversupply of red wine grapes.

“While the export figures to mainland China are very positive, the impact on total export value is much larger than volume due to the premium price point of most wine entering the market,” he said.

“As such, this increase is unlikely to reduce the oversupply of red winegrapes in the warm inland regions.”

Peter Bailey also said that the current figures do not necessarily reveal the full picture as "these first months are likely to be characteristic of re-stocking Australian wine after a long absence.

“Export levels are not equivalent to retail figures, and it will take time before it is evident how Chinese consumers are reacting to having Australian wine back in market. Despite this recent growth in exports, it is increasingly important to pursue market diversification and defend our share in other wine markets.”

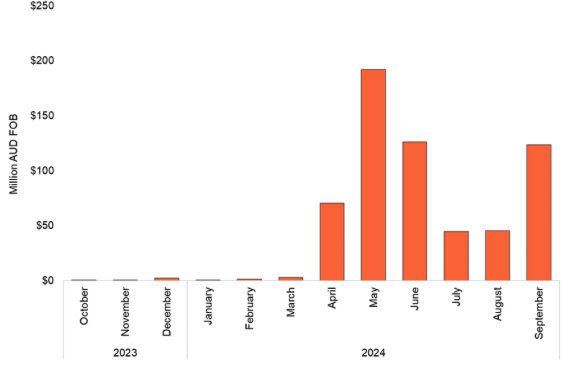

The value of Australian wine imports into Mainland China on a month by month basis are shown on the following graph:

China aside, Australian wine exports experienced a 3% volume decline to 585 million litres while value remained stable at $1.78 million. According to Trade Data Monitor, this 3% decrease was mirrored in the average volume data of the world’s top 10 wine exporting countries, with Italy, Spain, France, South Africa, Germany, and New Zealand each reporting declines in wine exports.

“Driving the results for markets, aside from mainland China, is the ongoing decline in global wine consumption as consumers moderate their alcohol consumption due to a more active focus on their health as well as cost-of-living pressures,” said Bailey.

“Shipping delays and increased shipping costs due to regional conflicts are also making it harder for wine exporters to get their products into market.”

While the UK experienced $9 million value growth and 7 million litre volume growth to become the second most important export market by value and the most important by volume, the US decreased $25 in value and 32 million litres in volume in the year up to September.

Peter Bailey said, “the most significant decline in volume was in exports to the United States, with nearly all the loss in volume being unpackaged wine, following a surge in unpackaged wine to the market throughout 2022 and the start of 2023.

“Exports to Canada stabilised in value as the decline in unpackaged wine eased and exports with an average value of $7.50 and above increased by 28% in value.”

Share the content