This morning Radio National's Fran Kelly spoke with Chief Executive of the Business Council of Australia, Jennifer Westacott. Westacott was very clear on China's role for Australia’s post-Covid economic recovery.

“We cannot recover without a strong trading relationship with China. And so, we have to make sure we don’t allow the relationship to deteriorate further,” she said.

“We’ve got to stay the course and comments about diversification I don’t think are particularly helpful …. It’s not a question about diversifying away from. Of course, we should diversify. We should do more with India, Japan and Indonesia. But diversifying away from China is just an opportunity that will go somewhere else. And that’s jobs a prosperity that will go to other countries.”

It makes for a delicate balance for Australian businesses trading with China.

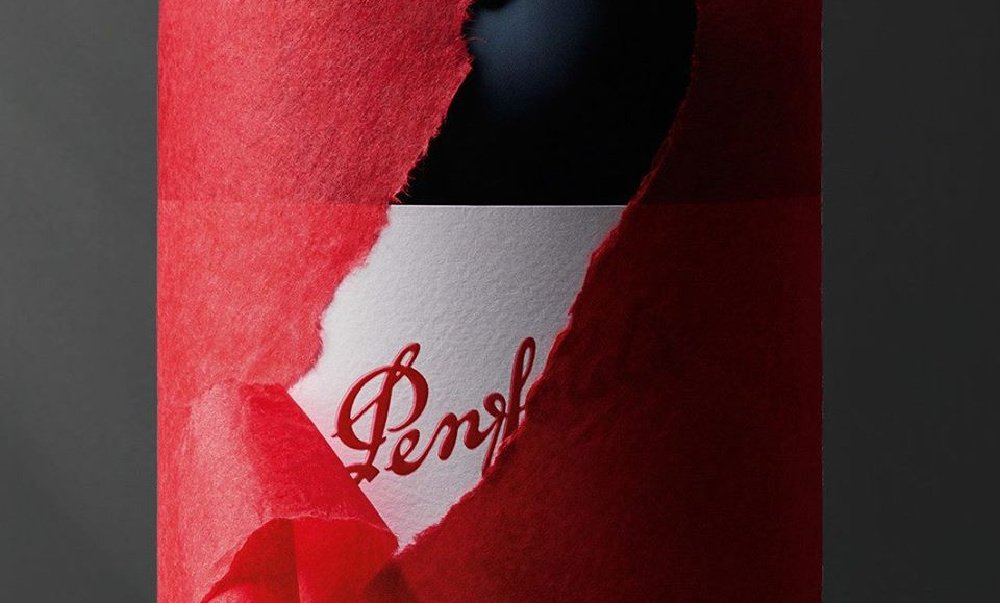

At last Thursday’s AGM for Treasury Wine Estates (TWE), Chairman Paul Rayner emphasised that TWE’s long time commitment to China remains an ongoing priority. The business first introduced Penfolds to China in 1995 and revenue for the Asia region for F20 was $617 million.

TWE's Asia division comprised 45 per cent of the company's total profits in 2019-20. It’s importance is immediately clear, as is the importance of diversification.

At the AGM, Raynor said: “Despite these challenges, TWE is a strong business…Diversification is at the heart of our strategy – we are diversified across multi-regional sourcing and sales geographies, our trusted and award-winning brand portfolio, the price points at which we play and the diverse range of consumer experiences that our brands offer. Critical progress was also made throughout the year on many important strategic initiatives including the implementation of a new operating model in our Americas region along with initiating the restructuring of the supply chain.”

As speculation around a trade strike from China continued to grow last week, TWE’s share price fell to a five-year low of $7.96 on Thursday, though shares have corrected and are back up to $9.05 today. Some importers have suggested to Australian exporters that they cease to bring wine across the Pacific for now and last Thursday, TWE also announced that it has paused plans to demerge the Penfolds label from TWE’s other brand portfolios.

Tim Ford, CEO at TWE said at his inaugural AGM presentation that: “We have decided to formally pause work on a demerger to focus on key priorities including trading through COVID, the US business restructuring and most specifically the Chinese Ministry of Commerce (MOFCOM) investigation in China. Therefore, the previously announced timeline for implementation of the potential demerger by the end of calendar year 2021 is no longer applicable.”

TWE has enjoyed retail growth in the US, Europe, the Middle East and Africa and in the UK, TWE’s portfolio grew 17% value in Q1, along with Continental Europe and the Nordics.

The business is optimistic about the prospects of earnings recovery with the exception of China – an uncertain territory. TWE issued a statement last week acknowledging that the business had received advice that the China Alcoholic Drinks Association (CADA) has submitted a written request to the Chinese Ministry of Commerce (MOFCOM) that imports of Australian wine in containers of two litres or less (Products) into China be subject to retrospective tariffs.

The outcome is not yet known but TWE said it will “continue to engage proactively with its customers in China to both assess the impact of this request on future import orders and support them in any new process requirements.”

China is uncertain territory, indeed. But it's just as essential as diversification for Australia's economic recovery.

Share the content