The Queensland Government is providing a $4billion economic relief package to support jobs and businesses during COVID-19.

The package includes waiving 2020–21 liquor licencing fees, payroll tax relief, funds for re-training and job-matching, and providing a $500 rebate on electricity bills.

Attorney-General and Minister for Justice Yvette D’Ath said the State’s 1100 pubs and clubs would get a three-month deferral on gaming machine taxes.

“Queensland pubs and clubs need our help to get through the coronavirus crisis,” D’Ath said.

“They’re the heart and soul of communities throughout the State and we’re determined to help them through these challenging times.

“From April through to June, we’re delivering a three-month gaming tax deferral for pubs and clubs.

“These tax deferrals are worth around $50 million in yet another important financial lifeline we’re delivering to the sector.

“In addition to this, around 50 licensees who have already paid their gaming machine taxes for March will have a total of $1.4 million returned to them.

“These measures come on top of the $22.7 million the government has already waived in liquor licensing renewal fees for 2020/21.”

Liquor sales for off-premises consumption

Holders of restricted liquor permits can no longer operate and are not authorised to sell takeaway alcohol.

Bottle shops must still operate in compliance with the Liquor Act 1992 and any other government requirements. All licensed premises should have a system of control in place to ensure the responsible service of alcohol and that sales are not made to minors or intoxicated persons.

With the easing of restrictions for movements and gatherings, if you’re currently permitted to sell takeaway food and alcohol, it still can’t be consumed inside or adjacent to the venue, regardless of the size of your outdoor area.

The limited easing of some home confinement and movement restrictions for public areas, such as parks, do not extend to licensed premises and adjacent areas.

With restrictions around some outdoor activities being relaxed, it’s also important to remind your patrons who purchase takeaway alcohol from your venue that in Queensland drinking alcohol in a public place is illegal and on-the-spot fines apply. The only exceptions are ‘wet areas' designated by a local council, normally for particular occasions such as a wedding in a park.

How you can currently trade in Queensland

Commercial hotel licence: Provide takeaway food and alcohol and operate takeaway liquor sale areas that are detached from the licensed venue, or within or attached to the licensed venue.

Community club licence: Provide takeaway food and alcohol and operate takeaway liquor sale areas that are within the licensed venue. Sales must be limited to members, staff and reciprocal members.

Subsidiary on-premises licence (café): Provide takeaway food and alcohol. Takeaway alcohol can only consist of packaged beer (bottled or canned), wine, cider and ready-to-drink beverages, such as premixed spirits. A maximum of 2.25 litres of liquor (total volume) can only be sold per transaction.

Subsidiary on-premises licence (restaurant): Provide takeaway alcohol together with a takeaway food order. Takeaway alcohol can only consist of packaged beer (bottled or canned), wine, cider and ready-to-drink beverages, such as premixed spirits. A maximum of 2.25 litres of liquor (total volume) can only be sold per transaction.

Commercial other - bar licence: Provide takeaway alcohol. Takeaway alcohol can only consist of packaged beer (bottled or canned), wine, distilled spirits, cider and ready-to-drink beverages, such as premixed spirits. A maximum of 2.25 litres of liquor (total volume) can only be sold per transaction including a 750ml limit on distilled spirits within the total volume of any transaction.

Producer/wholesaler licence: If you are a craft brewer or artisanal distiller, you can sell takeaway liquor produced on your licensed premises provided you are either:

- a craft brewer who produces between 2,500 litres and 5 million litres of product per year

- an artisanal distiller who produces between 400 litres and 450,000 litres of product per year.

You can also sell your own products in person, by phone or online for home delivery, as long as you meet these production requirements.

If you also hold a brewery licence under the Excise Act 1901 (Cwlth) you can do takeaway sales of your own product without having to meet the above production volumes.

Community other licence: Provide takeaway food and alcohol to members, staff and reciprocal members to allow for disposal of existing stock only. Takeaway alcohol can only consist of packaged beer (bottled or canned), wine, distilled spirits, cider and ready-to-drink beverages, such as premixed spirits. A maximum of 2.25 litres of liquor (total volume) can only be sold per transaction including a 750ml limit of distilled spirits within the total volume of any transaction.

Nightclub licence: Sell excess stock of pre-packaged liquor, if approved by OLGR.

Restricted liquor permit (excluding those in an area subject to an alcohol management plan): Provide takeaway food and alcohol to members, staff and reciprocal members to allow for disposal of existing stock only. Takeaway alcohol can only consist of packaged beer (bottled or canned), wine, distilled spirits, cider and ready-to-drink beverages, such as premixed spirits. A maximum of 2.25 litres of liquor (total volume) can only be sold per transaction including a 750ml limit of distilled spirits within the total volume of any transaction.

Sales through third-party sites

Customers can't order alcohol through a third-party – only liquor licensees have the authority to sell or supply alcohol. All orders have to be made with you, but you can have a third-party deliver it.

Third-party drivers don't need to be responsible service of alcohol (RSA) certified, but still need to obey the laws regarding the supply of alcohol to minors or to a person showing signs of intoxication.

Takeaway cocktails

Under current arrangements, you may be choosing to make and sell cocktails as packaged liquor for your patrons.

If you are doing this, ensure that you are complying with your responsible service of alcohol obligations, which are as important as ever, to limit the potential of alcohol-related harm.

Refilling growlers, squealers or other containers

You cannot refill a customer's growler or squealer (BYO containers) as takeaway alcohol, but you may sell your own growlers or squealers much the same as pre-packaged alcohol.

A licensed venue classifies as a food business, so you are required to maintain safe food standards, such as cleaning and sanitising equipment to limit the transmission of infectious diseases and prevent food contamination.

Cleaning and sanitising BYO containers is more difficult than a standard beer glass, so it's possible a customer's container could be contaminated and pose a risk to your staff and business.

Click here for more Queensland Government information

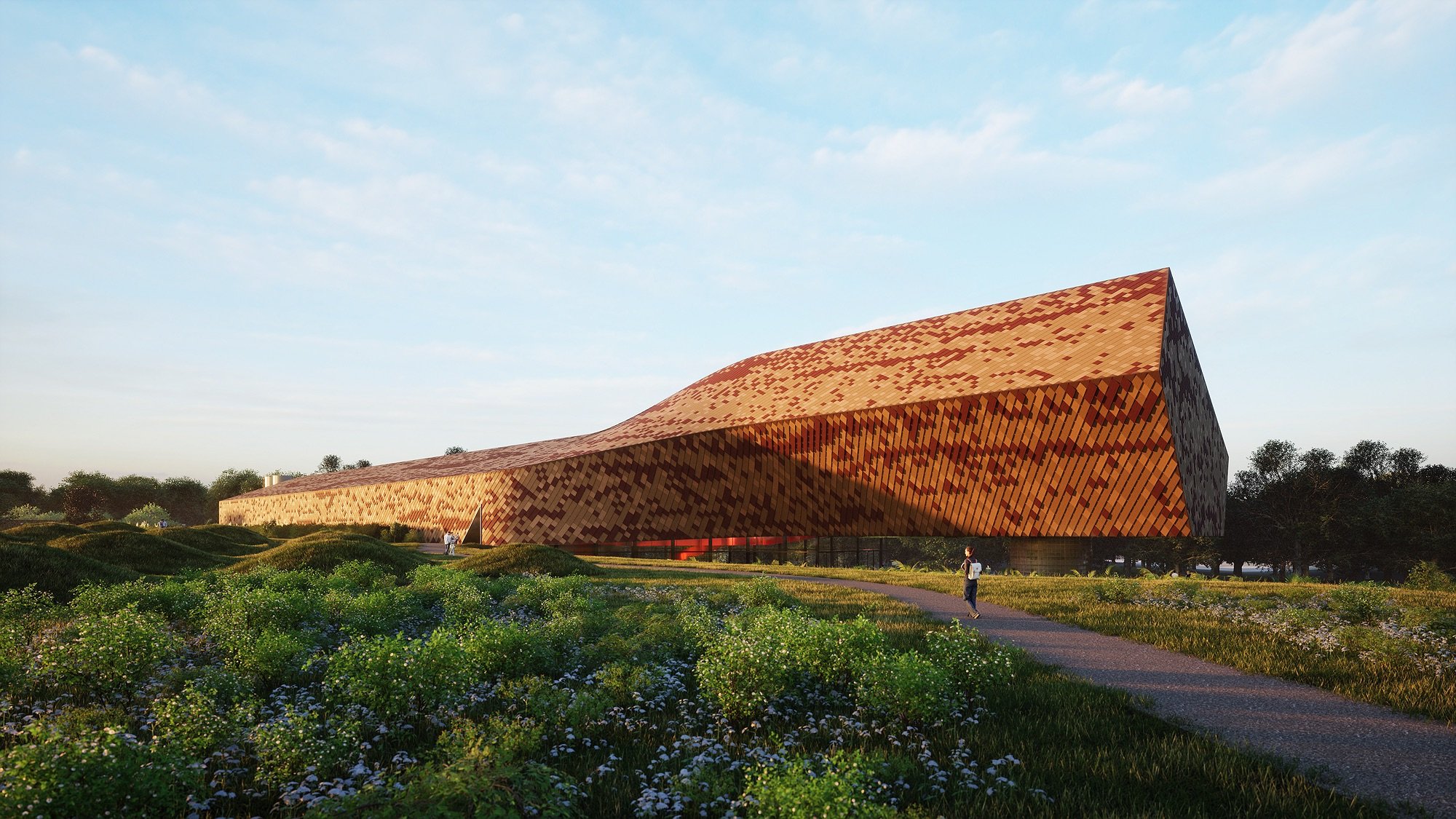

Pictured main: The Plough Inn

Share the content