Recently, Circana and CGA by NIQ predicted a notable uptick in sales these holidays for both Australia’s off- and on-premise respectively.

According to Jarna McLean, Circana’s Director of Health and Lifestyle, “we will see a stronger Christmas this year than last year; however, it will be quite a late Christmas.”

Similarly, CGA by NIQ’s Senior Manager of Customer Success Thomas Graham said that, “after tough trading conditions in recent months it’s a crunch period for spirits in particular, and with consumers’ confidence rising we can be cautiously confident about seeing a release of some pent-up demand for drinking out.”

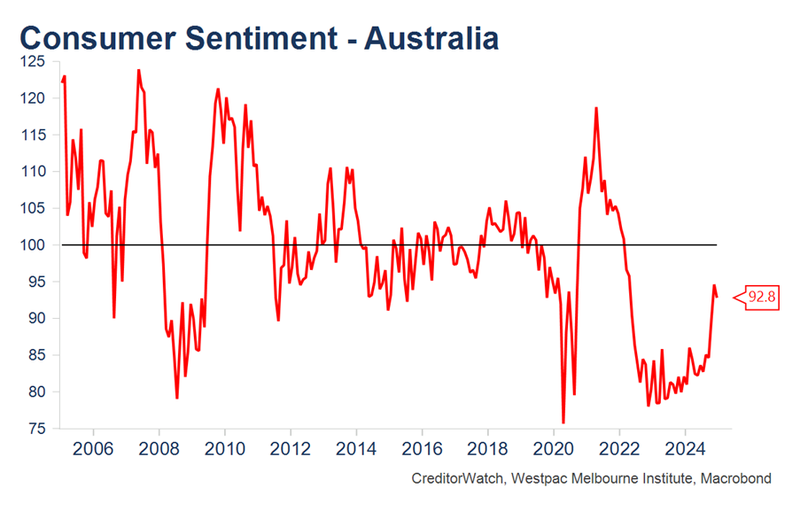

However, many economists remain cautious after the latest Westpac Consumer Sentiment Index showed a 2% dip this December.

“Consumer sentiment dipped slightly in December after having risen relatively strongly from lows between May and July,” said Ivan Colhoun, CreditorWatch's Chief Economist.

“Despite these rises, consumers overall remain slightly net pessimistic about the economic situation - as signalled by a reading below 100, which is where pessimists balance optimists.”

Colhoun says one reason for this drop in confidences is the re-election of Donald Trump as US President, a milestone he believes could have a potentially significant impact on Australian wine imports.

“Deterioration in questions about the outlook for the economy over the coming year and five years likely reflects uncertainty about re-elected President Trump’s widely-reported proposed significant tariff and immigration policy changes more than Australian developments in the past month,” he added.

Despite Jarna McLean’s hopes for a “return to a pre-Covid Christmas type performance” and for “more of a sustained summer key selling period,” Colhoun notes consumer finances “continue to be pressured by the much higher cost of living and higher interest rates.

“Private consumption growth has been very slow as consumers tighten expenditure on discretionary spending, due to the accumulated pressures from the higher cost of living and higher interest rates,” added Colhoun.

On a more positive note, a survey of 1,107 Australians commissioned by ASX-listed money lender MONEYME found that 35% of Australians will spend more money this festive period than in 2024.

This additional spending is expected to be particularly notable in younger generations, with 49% of Millennials to spend an average of $1,531 more than last year and 38% of Gen Z to spend $1,294 more.

For those cutting back on spending this Christmas, on-premise occasions and liquor purchases are among the categories most affected, ranking second and fourth respectively behind grocery foods (first) and travel (third). Out of the 64% of Australians planning on reducing their holiday spend, 33% said they will reduce ‘dining out’ related expenses and 24% said they will reduce ‘alcohol.'

Similar to CreditorWatch’s analysis, the MONEYME survey found that financial recovery is a concern for more than half of Australians, with younger generations most likely to feel the strain.

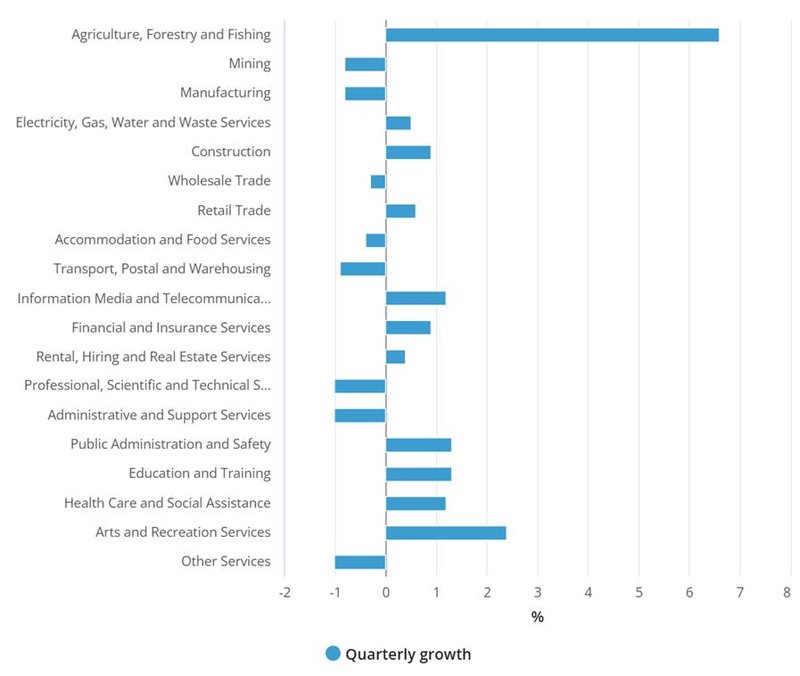

Interestingly, both CreditorWatch and Circana stressed the stronger sales results of retail when compared to pre-pandemic levels.

In its 2025 Business and Economic Outlook, CreditorWatch wrote: “COVID changed [the sector] overnight, with retailers benefiting from a significant shift in demand to goods from lockdowns and the inability to consume services, zero interest rates and government fiscal support. Supply chain disruptions allowed many retailers to push prices up, for many the first significant price increases for many years. Retail profits and business conditions surged.

Jarna McLean added, “when we talk about how overall performance is ‘on par’ (for want of a better term) versus 2019, keep in mind that that is really value sales. Now, if you double click down into that, there are a whole heap of pressure points that suppliers and retailers - particularly your small independent mum-and-dad bottle shop owners - are really feeling. A big part of that is around legislation, around taxation, and around the pressures that either of those puts against margin.”

CreditorWatch believes that Australia’s hospitality sector has been hit even harder over the past 12 to 18 months due to it being “even more discretionary" in nature.

“These industries that are heavily reliant on discretionary spending will, unfortunately, continue to find it tough until consumers feel a reduction in cost-of-living pressures, which won’t happen until we see a couple of rate cuts,” said Patrick Coghlan, CEO.

“Discretionary spending is one of the few ways that consumers can actively cuts costs, whether that’s eating out less, buying fewer coffees at cafes or not seeing so many concerts or theatre shows.”

Lightspeed’s Senior Director of Marketing APAC Simon Le Grand is hopeful a combination of recent tax cuts and the arrival of warmer weather will provide much needed respite for the industry.

Le Grand told Drinks Trade, “Tax cuts implemented in July may be positively influencing consumer spending… With peak season approaching, and longer, warmer days on the horizon, there's a renewed sense of optimism for the industry's performance. This combination of financial relief and seasonal demand could pave the way for a positive turnaround soon.”

Looking ahead, CreditorWatch anticipates an increasingly elevated level of pressure on Australia’s off- and on-premise liquor businesses up until the introduction of interest rate reductions in Q2 next year.

//

Leading hospitality industry stakeholders give advice on navigating economic headwinds

8.3% of hospitality venues failed in past year. What should operators do to stay afloat?

Share the content