The latest figures from Roy Morgan show independent alcohol retailers are taking market share from supermarket chains.

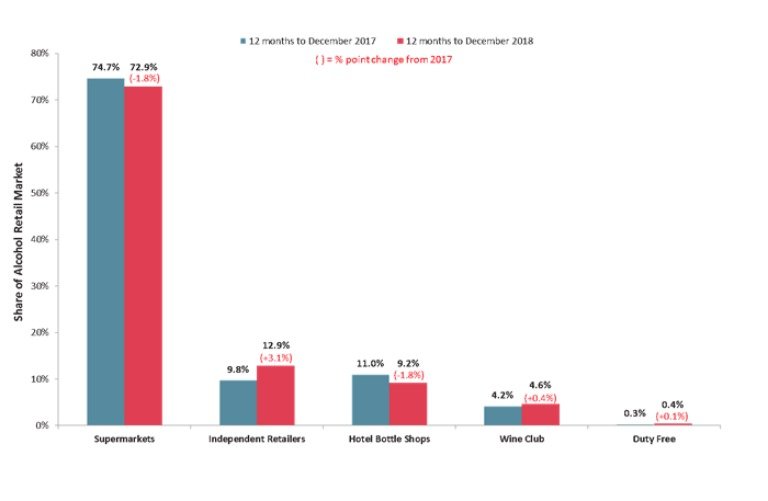

Although supermarkets still dominate the retail alcohol market, with 72.9% of the $15.4 billion market, over the last 12 months their share has fallen from 74.7%.

During the same period, the share going to independent retailers has increased from 9.8% to 12.9%, representing a gain of more than 130,000 customers compared to gain of only 25,000 for supermarkets.

These are the latest findings from the ‘Roy Morgan Alcohol Retail Currency Report’, which is based on Roy Morgan Single Source, comprising in-depth interviews conducted face-to-face with over 50,000 consumers per annum in their own homes, including over 7000 purchasers of packaged alcohol.

Over the last 12 months hotel bottle shops such as Bottlemart, The Bottle-O, Thirsty Camel, and Duncan’s Bottle Shop and supermarket retailers including the Woolworths Group (of Woolworths Liquor, BWS and Dan Murphy’s), the Coles Group (of LiquorLand, First Choice and Vintage Cellars), and other supermarkets (such as IGA and Aldi), had market share losses of 1.8% points."

The loss of customers however for hotel bottle shops was bigger with a drop of 235,000, while supermarkets gained 25,000.

Norman Morris, Industry Communications Director, Roy Morgan, said: “Despite the dominance of the supermarkets, the independent retailers have shown a market share gain of 3.1% points (to 12.9%) over the last year and are now ahead of hotel bottle shops which have fallen by 1.8% points to 9.2%.”

Major gains went to independent retailers such as Cellarbrations, Local Liquor and Mac’s Liquor, the with minor players such as wine clubs and duty free holding their own and in fact showing small market share gains.

“Our research shows a number of drivers of buying behaviour in this market, including proximity to other shops, low prices, an easily browseable range, special offers, expert staff knowledge and good service,” Morris said.

Share of alcohol retail market – supermarkets

Share the content