This week spirit producers in Australia woke up to the bleak prospect of paying just over $100 per litre in tax on their products, a rate not predicted to come into effect until 2029.

The excise tax on spirits increases twice annually in line with the Consumer Price Index (CPI), as released by the Australia Bureau of Statistics. The latest 2.2 per cent increase follows a record 4.1 per cent jump this time last year and a 3.7 per cent increase in February.

All in all, the hike is a shock to the industry, said Greg Holland, Chief Executive of Spirits & Cocktails Australia.

"This cannot be what the policymakers had in mind when they designed the alcohol excise regime in 1983, at which time there were only two spirits manufacturers in Australia. There are now more than 600 businesses subject to this tax," he said.

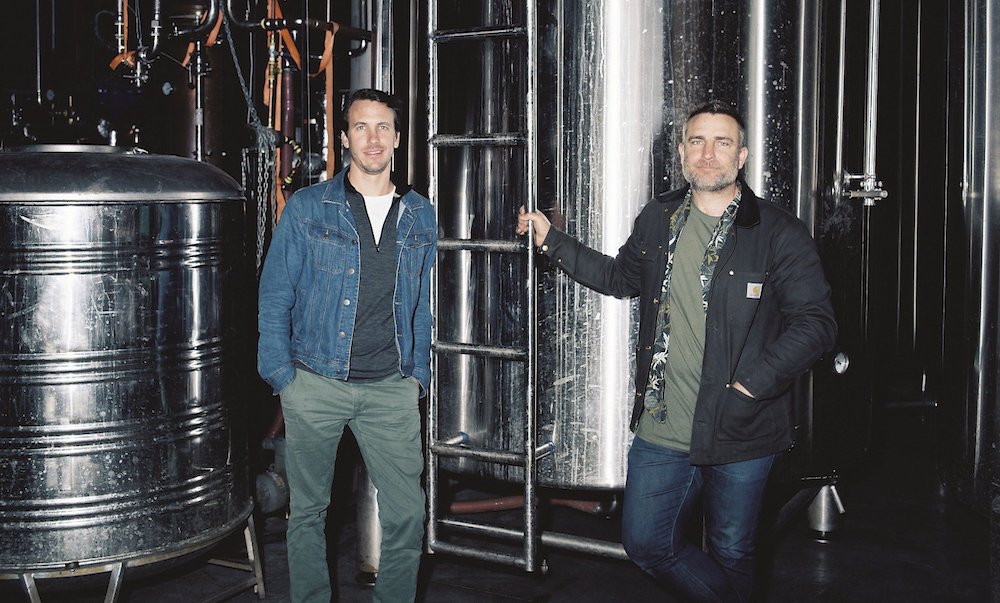

One of those 600 businesses is The Gospel Whiskey, an independent rye whiskey producer based in Melbourne's Inner North.

Andrew Fitzgerald, Co-Founder of The Gospel Whiskey, said the excise increase will have detrimental short and long-term effects on his business.

"Our immediate response is to pause all hiring that we had planned in the lead-up to Christmas and just focus on utilising the resources we have. We will need to assess what the consumer response is to the unavoidable increased shelf pricing.

"We have seen production [cost] increases across the board in recent months, with barrels increasing by 80 per cent and utilities almost doubling, so there is no room for us to wear the increased shelf price. This is the reason we intend to hold back on growth plans until we see the real impact," he said.

Paul McLeay, Chief Executive of Australian Distillers, said that reaching the $100 per litre milestone six years earlier than previously forecast means the industry is now at a crossroads.

"We can either get the policy settings right to support this industry that is showing so much promise or tax it into oblivion," he said.

Holland agrees, he said: "This situation is clearly untenable. We are calling on the Federal Government to freeze future excise increases so that the policy settings in this industry can be reviewed."

Fitzgerald said that the government has essentially hampered the growth of distilleries that are making a go of it. He said the plan is a "house of cards" for any brand wanting to scale up beyond a direct-to-consumer model.

He said smaller brands are in a better position to wear the increases as they are, to a degree, reliant on the excise rebate to make reasonable margins.

"This is all well and good until you go beyond the 12,500 bottles (at 40 per cent ABV) required to hit the $350k threshold. After that, margins are drastically reduced. It is brands like ours, independent and in a state of growth, that will be the hit hardest because we cannot afford to wear the excise increases.

"The end result is we will never get to the scale of the big international brands and, by default, never compete on price point, which is rarely understood by the consumer.

"Still to this day, consumers comment on ours and other Australian whiskey, asking, 'Why is it so expensive?' My response to that moving forward will be 'because your government hates supporting emerging industries.'"

Spirits & Cocktails Australia and Australian Distillers have created a handbook to equip industry members with the tools needed to exert pressure on the government to consider their request for an excise freeze.

Featured Image: The Gospel co-founders Ben Bowles and Andrew Fitzgerald.

Stay up-to-date with the latest industry news with the Drinks Trade e-newsletter.

Share the content