Despite already having the third highest spirits tax globally, the Australian Federal Government continues to increase the excise in line with ABS inflation data every February and August. The latest increase, which came into effect on 5 August, saw this tax increase more than $2 per litre of pure alcohol to a new value of $103.89.

Prior to this in March, an economic modelling commissioned by the Australian Distillers Association and Diageo Australia demonstrated that Federal Government policy and regulatory barriers including the spirits excise tax are thwarting Australian spirits exports of growing to a potential worth of $1 billion by 2035.

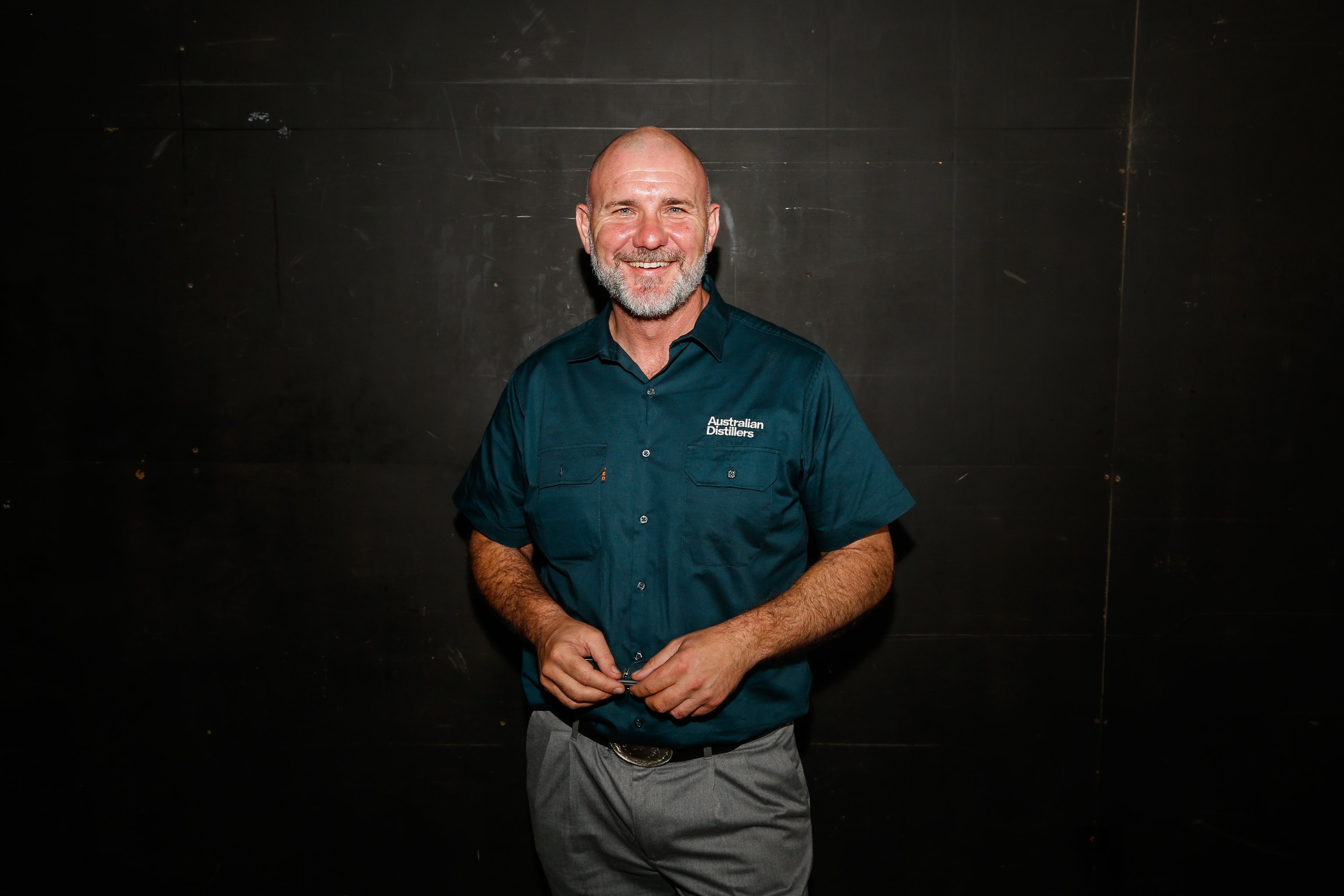

Drinks Trade reached out to Paul McLeay, CEO of the Australian Distillers Association, to gain a better understanding of how current government policy is putting Australia at a disadvantage when compared to its international competitors.

Drinks Trade: Comparing domestic and international spirits production, what is the exact impact of our current spirits tax policy on the sector?

Paul McLeay: From a really granular producer perspective, we don't have a scale that these international brands have. That's partly because you take the example between, say, an American company and an Australian company. Our tax is pushing on $104. In the US, the excise is $14 per litre of alcohol. That means they've got $90 a litre to make choices about either investing in their brands and their businesses, or they're developing export markets, or passing on that saving to the consumer. Australian businesses don't even get that, because we send that $90 a litre extra to Canberra.

That means that, one, we are disadvantaged on the international stage, and then the second thing is, whilst there is a cost of living crisis, it's very difficult to pass on any increases. And it just means that our local producers have been absorbing this increase for the last two years and longer.

DT: Do spirits importers pay any additional tax when importing into Australia?

PM: No, it's exactly the same. You pay whatever tax is in your home market. So when Starwood sells their product in America, they don't pay any tax in Australia, they only pay it when they get to America, which is why a bottle of Four Pillars gin is cheaper in LA than it is in Melbourn: even with all that freight costs and extra handlers and freight forwarders and distributors and all those extra fees, it's still cheaper, much cheaper, to buy a bottle of Four Pillars gin in Los Angeles than it is in Melbourne because they pay the local tax there because our tax is so underweight.

Similarly, a bottle of Jack Daniels costs a lot more in Australia than it does in Louisville, because there they're paying America's tax and in Australia they pay Australian tax. And I suppose that might lead to the thinking where you go, well, if everyone's paying the same, why do we care about it? And it comes back to what i said earlier, that the American producers have an advantage over us, because at home, whilst everyone's paying $14 a litre, it means that they've just got more capacity to reinvest in their business, grow their business and develop export plans, because their tax is at a reasonable rate. In Australia, our tax is so high it becomes a much higher proportion of the final sale, and that those choices, to the extent of $90 per litre, are taken away from us.

DT: Is Australia’s current biannual tax excise a potential inhibitor to attracting foreign investment?

PM: Absolutely, because the international companies say they cannot invest where there is so much uncertainty.

They say, how do we make those investment decisions, particularly for our dark spirits, which do need to be laid down for that period of time… They've said to the Australian government, we find it very difficult to invest in Australia because the excise is so high. Compared to New Zealand - just across the ditch is 30% lower - that's more attractive from those international players.

There's 700 distilleries and only four of them have had direct foreign investment. Compare that to the craft beer industry in Australia: as soon as some show some strong signs of market penetration, they do get snapped up by it, they do get that global investment that we're not getting in the spirits industry because our excise is so high. And we do know that, within the spirits category, there are some very major players.

DT: Where do you see the potential for Australian spirits in the export market?

PM: We think about what we are being recognized at our global spirits awards. Certainly, our whiskies have a unique flavour. Global consumers know nothing tastes like Australia and our production processes and our climatic conditions and our ingredients means that we do have a unique flavour…. I think that the London spirits awards last year developed a new category called Australian whisky, because they know that there is an excitement around the extremely high quality and unique flavour of Australian whiskey is something that global consumers want.

Then when it comes to our gins and our use of native botanicals that you simply cannot get anywhere else in the world, [that] gives us a lovely flavor that a global consumer is going to want.

And then, of course, Australian rum is emerging. And we're about to see a lot more of that hitting our product.

The markets that we see have the biggest potential is Asia: it's right on our doorstep [and] They already love Australian products. Australian wine is so successful there. And then, of course, other large whisky producing countries, like the US/America, and then third would be Europe.

//

To learn more, read this recently published Drinks Trade article, in which Paul McLeay discusses the latest spirits tax hike, current industry pressures, and what the industry should expect moving forwards.

Share the content