The latest NIQ Full View of Liquor report further reinforces the idea that cost of living pressures are impacting liquor consumption habits in Australia. According to the report, these pressures are not only affecting the frequency, location and average spend of drinking occasions, but also the types of alcohol being consumed.

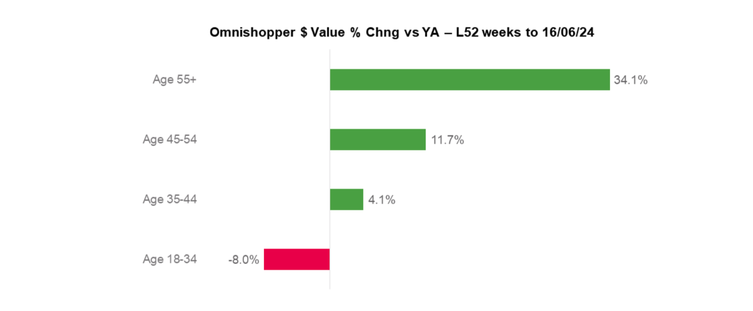

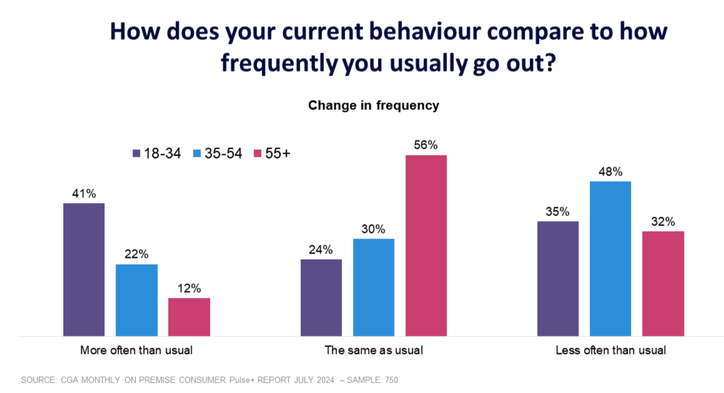

Overall, more Australian consumers are now drinking at home instead of going out. 39% of consumers surveyed in CGA Pulse+ report said they are now Going out less often when compared to June, while 37% said they are Going out the same and 24% are Going out more often. However, within this, younger consumers are now visiting pubs, bars, and restaurants more often than before but spending less, whilst older demographics are visiting less often but spending more.

According to Marco Silva, Customer Success Director at NIQ, “diving a bit deeper, we can see that demographic differences play a key role in on-premise consumer occasions and categories, and helps to understand why young consumers are still going out. Gen Z (40% share of all occasions) and Millennials (41%) prioritise these experiential occasions more than Gen X (36%) and Boomers (32%).”

This finding reflects the tendency for younger demographics to seek out more experiential occasions, thus presenting an opportunity for venues to specifically target the demographic’s unique needs. As it stands, 70% of both Gen Z and Millennial consumers say they prefer different drinks at bars and restaurants to home, compared to 40% of Gen X and 31% of Boomers.

“In line with their quest for experiences, we also note the high proportion of these younger consumers who prefer different drinks at bars/restaurants compared to home,” said Silva.

“This suggests that On-Premise consumption/visitation plays a more unique and differentiated role in their lives than it does for older consumers, making it less replicable at home and could be one of the reasons why many young consumers are either going out as much as before or even more often despite the higher cost-of-living.”

The relationship between on-premise visitation frequency and and total spend value can be viewed in the following two graphs provided by NIQ:

Drinks Trade recently asked CreditorWatch's CEO Patrick Coghlan about the severity of the current situation for hospitality venue owners in Australia.

"The number of insolvencies we’re seeing at the moment is at a record high, and we’re starting to see a record high for defaults and payment times as well, so all of the sort of key indicators show that it is really tough out there for businesses," he said.

"Despite that, though, Australian businesses are really well set up to deal with it, so it’s not panic station."

NIQ’s Full View of Liquor report, which combines the NIQ Omnishopper panel with CGA’s OPM (On-Premise Measurement) & OPUS (On-Premise User Study), reveal beer to be continuing to grow in Australia’s on-premise, up 1.4% by volume when compared to last year. Recently, Lion Australia's Marketing Director Kerry Appathurai told Drinks Trade that "beer remains an important foot traffic driver for our customers" despite the "beer industry, like many, [having] faced some serious headwinds."

By contrast, spirits sales contracted 7.7% over the same period, suggesting that spirits are more impacted by factors such as price increases and perceived value for money. The most notable exception to this is golden rum, which saw a total on-premise value growth of 7.6% in the 12 months to July.

“With many consumers still facing pressure on their spending, it’s clear that trading conditions in Australia’s spirits market are tough at the moment,” said James Phillips, Client Solutions Director at CGA by NIQ.

“However, it’s a very nuanced picture with pockets of growth opportunities for venues and suppliers—especially in rum.”

//

NIQ gives insight into ways Australia’s liquor industry can capitalise on omnichannel

CGA by NIQ webinar analyses trade/supplier relationships and emerging on-premise trends

Government prepares next week’s beer tax hike as more breweries go under

How bad is Aus liquor’s current economic crisis and what options are there?

Share the content