While China might have dominated wine headlines over the past year following the 29 March tariff removal, the domestic market continues to remain responsible for 42% of all Australian wine sold, along with offering opportunity for importers.

Here, Wine Australia’s Manager of Market Insights Peter Bailey offers a comprehensive overview of Australia’s domestic market:

“With a 40% share, the domestic market is the biggest market for Australian wine. And, like many mature wine markets around the world, it has been faced with declining consumption as many Australian consumers have been moderating their intake for a variety of reasons, including a greater focus on health and wellness and responding to cost of living pressures.

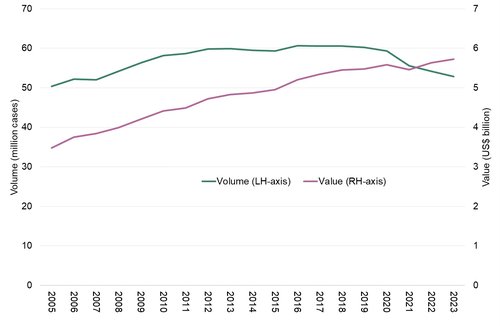

Data from IWSR shows that the volume of wine consumption in Australia peaked in 2016 and has been falling since, with the decline accelerating following the COVD-19 pandemic in 2020 (see Figure 1). In comparison, the value has been steadily rising since 2005, with a temporary interruption in the upward trend due to the pandemic. While some of this growth in value is inflationary, it also reflects that, while volume has fallen, consumers are spending more per bottle, choosing to consume less but spend more.

Figure 1: Wine consumption in Australia over time

Source: IWSR

The latest retail figures for the domestic off-premise market from Circana show that, for Australian wine, these trends have continued in 2024. For the 12 months ended September 2024, the value of Australian wine sales increased by 0.5% while volume declined by 2%. In comparison, sales of imported wines fell in both value and volume; by 3% and 2% respectively. As a result, Australian wine increased its value share of the domestic off-premise market by one percentage point to 76% and maintained its volume share at 85%.

Trends by variety and style

There are some differences in performances by variety in the domestic market.

According to Circana, Sauvignon Blanc is the number one category by value with a 14% share of the off-premise wine market and sales increased by 0.4% in the 12 months ended September 2024. Strong growth at less than $6 per bottle more than offset declines between $15.00 and $29.99 per bottle. New Zealand was the number one country of origin for Sauvignon Blanc with a 58% share but sales declined by 1%. Australia was second with a 42% share but sales increased by 2%.

Shiraz was the second biggest category with a 13% value share but sales continued a downward trajectory, down 2% in the last 12 months. The bright spot for Shiraz was at $15.00 to $19.99 per bottle, with sales up 2%, and holding a 28% share of total Shiraz sales. Virtually all Shiraz sales were Australian.

Chardonnay was the third major category with an 8% share of value and sales increased for the second consecutive year, up by 2%. The strongest growth for Chardonnay came between $15 and $29.99 per bottle, with sales up 4% in this segment, and holding a 43% share of total Chardonnay sales. Chardonnay sales were dominated by Australia with an 85% share and sales grew by 1%. The only other major competitors were the United States with an 8% share and New Zealand with 6%. US sales increased by 17% while New Zealand sales fell by 4%.

Cabernet Sauvignon maintained fourth place by value, but sales declined for the second successive year, falling by 1%, but its market share was steady at 6%. Like Shiraz, $15 to $19.99 per bottle showed growth for Cabernet Sauvignon, with sales up 4%. This is the biggest segment for Cabernet Sauvignon, accounting for 29% of the value of the varietal’s sales. Just under 100% of Cabernet Sauvignon sales were Australian.

Outside of the four major categories, there was growth in a number of varietals. For reds there is a shift towards lighter styles. The two stand-out categories were Pinot Noir and Grenache, with the value of sales up 4% and 9% respectively. For both varietals, the sweet spot for growth was between $15 and $29.99 per bottle. Australia holds a 77% share of Pinot Noir sales and 81% of Grenache. New Zealand was the main competitor for Pinot Noir while France and Spain were the only significant competitors for Grenache.

Off much smaller bases, there was also growth in Sangiovese and Nebbiolo. Australia was the dominant country of origin for Sangiovese with Italy second with 20%. On the other hand, Italy dominated sales of Nebbiolo with a 93% share while Australia held only a 7% share.

For whites, in order of market size, there was growth in Prosecco (up 10%), Pinot Grigio (up 6%), Pinot Gris (up 6%), Moscato (up 4%) and Riesling (up 2%). The biggest segment for Prosecco, Pinot Gris and Moscato was $15.00 to $19.99 per bottle while for Pinot Grigio was at $10 to $14.99 per bottle and Riesling at $20 to $29.99 per bottle.

Australia was dominant in Prosecco with a 76% market share ahead of Italy with 24%. While Australian Prosecco sales grew by 14%, Italian Prosecco sales declined by 3%.

Australia is clearly number one in Pinot Grigio with an 89% share but is second behind New Zealand (57%) in Pinot Gris sales with a 43% share.

Almost all Moscato and Riesling sales were Australian.

The rosé category also flourished, with the value of sales up 5% and its market share 5% compared to Prosecco with 4%. Rosé is a very competitive category. Australia is number one with a 58% share, followed by France with 22% and New Zealand with 16%.

Cost of living pressures are having an impact on sparkling wine sales, with the value of sales falling by 4%. An 11% decline in Champagne sales more than offset a 0.4% increase in bottled white sparkling sales over the year with Australia holding an 85 share of bottled sparkling white sales.

This article was written by Peter Bailey for Drinks Guide 2025, which was distributed nationwide in December and can be viewed digitally here. If you did not receive a physically copy and would like to be added to the Drinks Trade/Guide magazine mailing list, get in touch with the team now.

//

Signs of stock adjustment after Australian wine sales outstrip production for 2nd consecutive year

Australian wine exports reach highest levels since August 2021

Wine Australia and ASVO launch national support network for young wine professionals

Share the content