Roy Morgan research has revealed the gender and age split of customers at Australia's most popular bottle shops.

The findings in the ‘Alcohol Retail Currency Report’ come from the Roy Morgan Single Source survey, derived from in-depth face-to-face interviews with 1000 Australians each week in their homes.

While men make up the largest proportion of Dan Murphy’s customers (58%) and BWS customers (52%), women shoppers are the largest customer base of Cellarmasters (57%).

The quintessential Dan Murphy’s bottle shop customer is more likely than the average Australian to ‘not trust the current Australian Government’, ‘worry about getting skin cancer’ and ‘trust well-known brands better than the stores’ own and he’s far more likely to ‘like to drink wine with his meals’, ‘always read the business section of the newspaper’ and ‘like to go away on weekends’.

“For the generally younger BWS bottle shop customer he’s more likely than the average Australian to ‘choose a car mainly on its looks’, ‘spend more when my children come shopping with me’ and ‘always ready to try new and different products’,” Roy Morgan said.

“He’s far more likely to ‘enter competitions which are on packets or labels on products’, ‘redeem coupons to get discounts or special offers’ and more likely to agree that ‘credit enables me to buy the things I want’.”

On the other hand, a pen portrait of a Cellarmasters customer will show “she is more likely than the average Australian to ‘buy additive free food’, ‘favour natural medicines & health products’ and ‘be concerned about her cholesterol level’.”

“She has a touch of patriotism and is more likely to ‘try to buy Australian made products as often as possible’ as well as ‘keep up-to-date with new ideas to improve her home’. She’s also almost three times as likely as the average Australian to ‘like to drink wine with her meals’ – far higher than Dan Murphy’s or BWS customers.”

When it comes to customer age, Australians between 50-64 years of age are Dan Murphy’s most significant cohort, with 949,000 of them purchasing alcohol from Dan Murphy’s in an average four week period. For BWS it is the 845,000 Australians aged 35-49 years of age who comprise the largest share of their customers, while almost half of Cellarmasters customers are aged at least 65+ years old.

Woolworths announced last week that it had begun to reposition Dan Murphy’s in the rapidly evolving drinks market, delivering improvements in service, range, price and convenience.

"While early days, the results are very encouraging," it reported, noting the repositioning is “beginning to resonate with customers” through its discovery-based product and service strategy.

In-store customer experience was being enhanced with the introduction of wine merchants in key stores to improve team product knowledge and customer satisfaction.

The chain has also responded to consumer consumption trends, introducing more half-bottles to its range.

It is also refashioning and transforming ranges around “local” themes. For example, shoppers in Sydney will have showcased local Sydney craft beers at a local Dan Murphy’s while a new outlet in Tasmania has a Tasmanian whiskies section.

Dan Murphy’s has also found that customers are reacting positively to the idea of discovering new and exciting beverage types or brands when they enter a store, rather than a set-and-forget approach.

Woolworths bottle shops prove most popular

Woolworths Group maintains the highest market penetration among alcohol retailers, with 60.7% of Australian alcohol buyers purchasing from its stores in an average four-week period.

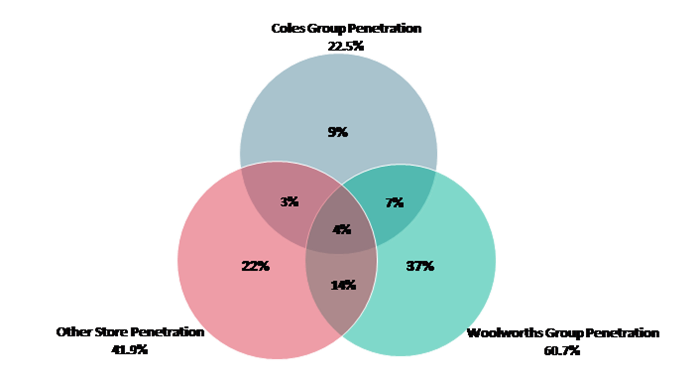

Coles Group including First Choice Liquor, Liquorland and Vintage Cellars has penetration of 22.5% and 41.9% visit other stores including supermarkets such as ALDI and IGA, hotel bottle shops and a large range of independent retailers.

When looking at the unique customer penetration of retailers, Roy Morgan said Woolworths Group holds the highest proportion with 37% of alcohol buyers purchasing solely from its stores compared to 9% who solely purchase from Coles Group while 22% only visit other stores and independent retailers not including the two majors.

Only one in 25 alcohol buyers purchase from all three including Woolworths, Coles Group and from other stores in an average four weeks.

Roy Morgan noted that despite being the dominant player in the market, Woolworths announced earlier this year it will be de-merging or selling its bottle shop interests including leading brands such as Dan Murphy’s, BWS – Beer, Wine & Spirits and Cellarmasters over the next year.

Michele Levine, CEO of Roy Morgan, said: “The decision by Woolworths to sell or divest the Endeavour Drinks Group makes it more important than ever for retailers in the Australian liquor market to have a firm grasp on the fortunes of rival liquor retailers as well as the choices and decisions made by liquor customers when determining where they will buy their next cask of wine or slab of beer.”

Share the content