Due to its unique positioning as a specialist in all areas of Australia’s liquor industry, NIQ is able to provide a full overview of liquor consumption, often revealing unique opportunities and challenges as a result.

Here, NIQ’s Senior Manager of Customer Success - Pacific, Thomas Graham provides insight into what Australia’s liquor industry should expect in 2025, according to the data:

“The last 4 years have been topsy-turvy for the liquor industry, globally and in Australia. I’m sure over this period, you’ve found yourself scratching your head and wondering what is next. It’s difficult not to get caught up in the noise of negativity.

NIQ has invested heavily into unmasking the true stories unfolding within the liquor industry in Australia. Our belief is that to be a successful manufacturer, retailer or operator, you need a holistic view of category, shopper, and consumer across Off-Premise, On-Premise, Offline and Online.

Only with this full view can you uncover the flow of consumption, pinpoint specific opportunities for your brands and understand how these are interwoven across the total liquor landscape.

So, what can the latest NIQ data tell us about this flow of consumption?

Let’s first establish what we know about the past 4 years. In 2020, liquor consumption saw a sharp flow towards at-home, continuing into 2021 and the early stages of 2022. From 2022 we entered the revenge spending stage, with consumers making up for lost time in the On-Premise.

In 2024 financial pressures had led to a more reserved On-Premise attitude, with consumers being more calculated in when and where they go out. Here at NIQ, we reported in mid-2024 a flow back into at-home consumption.

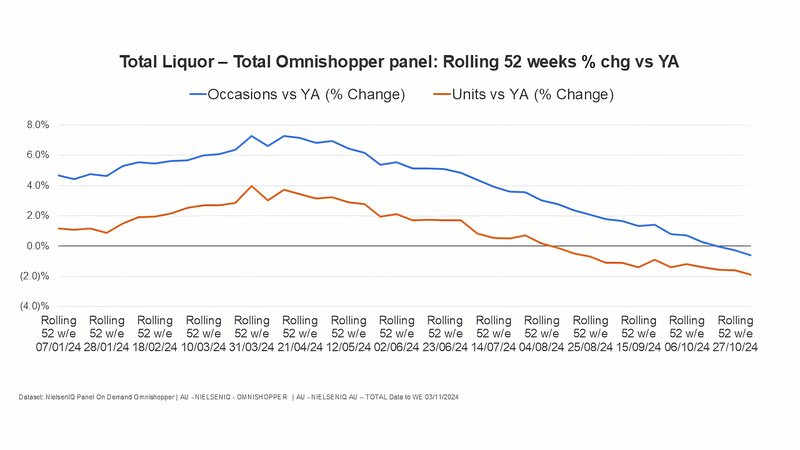

However, our most recent data from the last few months suggests more change. In retail, we’ve monitored year-over-year trends in the total number of liquor purchasing occasions and the total number of units purchased. In 2024 growth in occasions and units peaked during the middle months of the year but have since followed a consistent downward trend and now both witness year on year decline.

The Grand Return of the On-Premise for 2025?

Coinciding with this softer performance from key shopper measures are early indicators of a greater willingness to visit and spend in the On-Premise. Our Spring 2024 OPUS data has revealed a significant increase in monthly On-Premise occasions (consumers, on average, are visiting 2 times more per month compared to the same time last year).

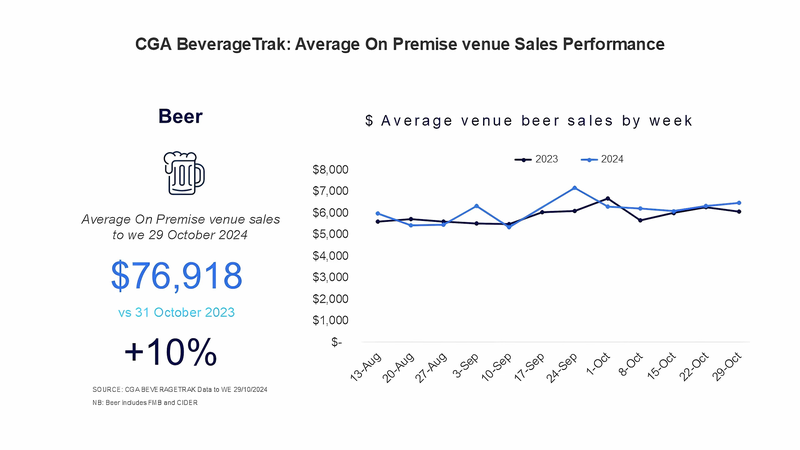

Additionally, sales performance of liquor in On-Premise venues, shows clear signs of recovery. Looking specifically at the beer category, a particular bright spark, our Pulse+ sales report, an early indicator of sales trends, shows +10% in beer $ sales for the average venue over the recent QTR, with the last 4 weeks all above their 2023-week comparisons.

Notably when analysing the other categories, spirits is relatively flat in terms of recent sales performance, whilst wine continues to underperform YoY.

How to Position Yourself for Success in the 2025 On-Premise?

If the On-Premise is primed to benefit from a renewed appetite and flow of consumption, what might this look like?

Here at NIQ, we anticipate several key battlegrounds for suppliers and venue operators to navigate to succeed in 2025.

- The insatiable quest for experiences and the personal drive for social currency: Experience-led occasions are now the biggest contributor to total On-Premise occasions in Australia, making up 39% of all occasions, surpassing both solely food-led and solely drink-led occasions share in 2024.

This means consumers are increasingly seeking out specific venues that cater to unique and memorable experiences that they can then share on social media. For operators, it is about putting experiences at the heart of what you do and effectively communicating this to your target customers. For drinks suppliers, it is about understanding how your brands can uplift and elevate your partners in-venue experiences. - The shifting dayparts and impact on consumption:

Since the re-emergence of On-Premise visitation, there has been a clear and intentional shift towards consumers going out earlier in the day, leaving earlier and foregoing the typical late-night antics. This disproportionately impacts the spirits category, with traditional serves more suited to the later stage of the visit. The impact is apparent in our On-Premise Measurement (OPM), with glass spirits volume sales in the bar channel (-14.3% over L52 weeks to 10/09) trending worse than glass spirits across the total On Premise (-9.8%).

Spirits brands of today may need to rethink some or all of their On-Premise strategy, to ensure they are well-equipped to meet these changing needs. - The evolving tap-line up:

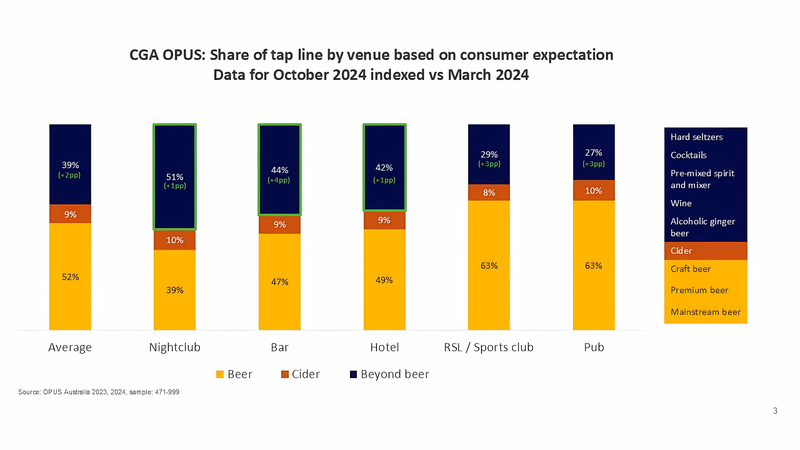

You may or may not be tired of hearing us talk about RTDs. Regardless, the momentum remains, and if anything, it has sped up, with large operator groups speaking out on the growing importance. Likewise, small and large manufacturers continue to launch new non-beer tap products. Our latest round of OPUS research reveals the need to rethink the number of taps each category should own:

Presenting equal challenges and opportunities for drinks brands and operators to navigate what the optimal tap-line should really look like in today’s world.”

Share the content