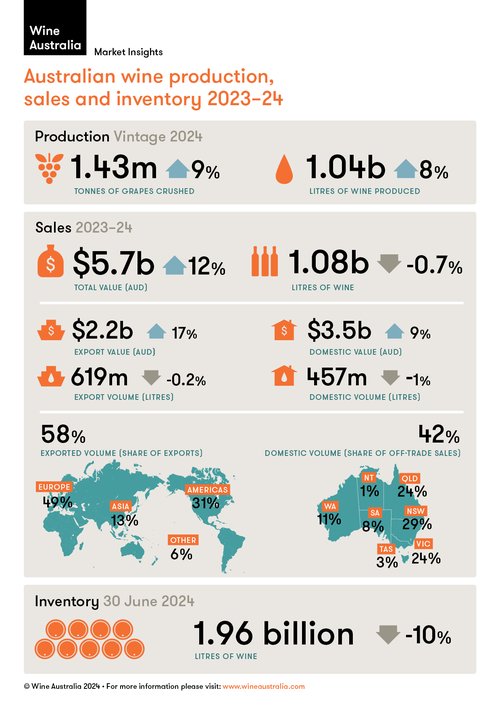

For the second consecutive year, total sales of Australian wine have outstripped total production volume despite overall sales volumes also contracting.

The news, which was first published yesterday in the Australian Wine Production, Sales and Inventory Report 2024, documented a total production of one billion litres, or 116 million 9-litre cases; four million cases less than the 1.08 billion litres sold over the same period.

This makes vintage 2023-24 the second smallest in 17 years at 16% below the 10-year average. However, it was still a significant 8% ahead of last year, the smallest vintage since 2007.

Australia’s production levels are reflective of global trends. According to the International Organisation of Vine and Wine’s First Estimates report, vintage 2024 is expected to be “a 2% decline from the already low 2023 volume,” and a “13% reduction against the ten-year average.”

“This positions 2024 production as potentially the smallest global output since 1961,” wrote the OIV.

Wine Australia’s Manager of Market Insights Peter Bailey attributes Australia’s low production volume to a mix of environmental and market-induced factors.

“This was another difficult season in many regions, with heavy rainfall and flooding, widespread windy conditions affecting flowering, and dry spring weather leading to cold nights and the potential for frost damage,” he said.

“However, the result has also stemmed from deliberate decisions by grapegrowers and wine businesses to reduce production or intake, driven by the current economic and market conditions affecting demand for wine.”

The total amount of Australian wine sold also took a hit this year even with the reopening of the China market.

Exports to China increased from 1 million litres to 32 million litres, 96% of which was red table wine. Despite this, production volume increase was spearheaded by a 20% increase in white wine, with red production decreasing by -2%.

Peter Bailey warns that the growth of wine exports into China is likely due to the re-stocking of Australian wine in the market after a long absence, and does not necessarily equate to retail sales.

“It will take some time before there is a clearer picture of how Chinese consumers are responding to the increased availability of Australian wine in–market,” he said.

The two consecutive years of sales exceeding production have led to a 14% reduction in stock-to-sales ration and a 10% reduction in inventory.

As can be seen in the following Wine Australia Production, Sales and Inventory surveys and ABS graph, white wine stock-to-sales has fallen below its 10-year average, while red is at its lowest level since 2020-21.

_____graph___

Despite the above graph representing a move in the right direction, a return to production levels in line with the 10-year average would be unsustainable with current sales figures.

Bailey said, “any increase in production is likely to result in stock levels rising again, unless there is a corresponding increase in sales. This is a particular concern for reds, where the stock-to-sales ratio is still well above the long-term average.”

Unfortunately, Bailey says ““There are no easy solutions for increasing sales.

“Total global wine imports to China have fallen by two-thirds since 2017, so it is unlikely that we would return to our previous level of exports to that market,” he continued.

“Meanwhile our wine sales to the rest of the world, including Australia, have been under pressure for the past several years as consumption has declined and competition has increased. We are unlikely to see a return to our previous average of 1.2 billion litres in the next few years.”

Share the content