Australian FMCG suppliers and retailers are facing unprecedented change as they adapt to meet shoppers' demands, according to IRI's Alistair Leatherwood.

IRI’s Retail Outlook for 2019 and Beyond, ‘Staying One Step Ahead’ has outlined the issues contributing to the challenges that are facing the FMCG sector.

Leatherwood said it was important for FMCG retailers to invest more heavily in data and technologies to better understand and meet the expectations of today’s hyperconnected consumer.

“Consumers across the world today are inundated by choice and have easy access to a wealth of information," he said. "This puts unprecedented power in their hands and brands are scrambling to meet their changing expectations.

“The insights that brands can glean thanks to digital technologies provide the opportunity to experiment with new products, new retail environments and whole new business models.”

Younger generations driving online shopping

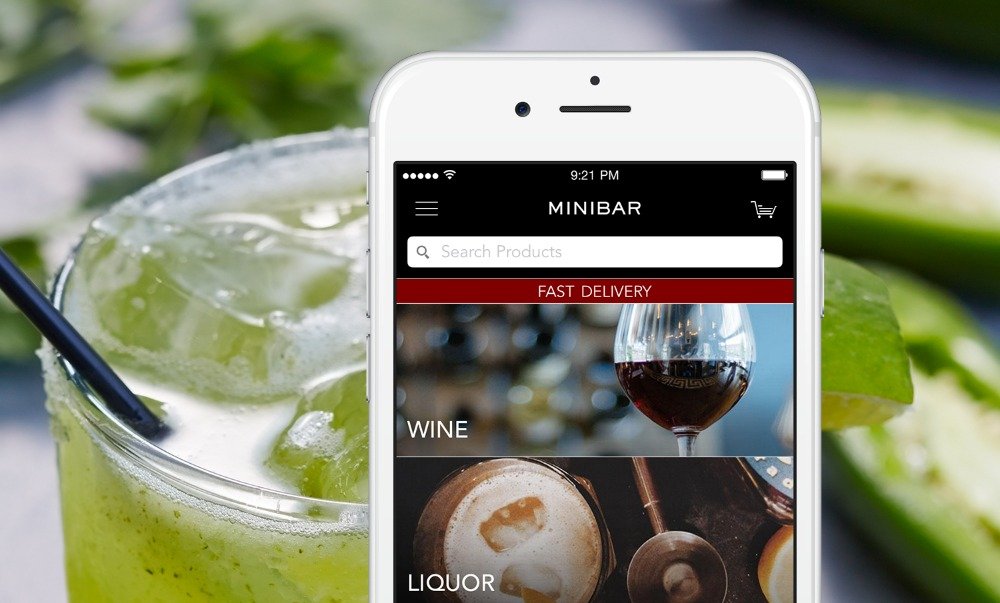

FMCG retailers are already navigating enormous change to cater to changing consumer demands; leading the charge is e-commerce, or online shopping, a rapidly growing market of an estimated worth of $3billion across the grocery, liquor and pharmacy channels in Australia in 2018.

While online still comprises a relatively small share of sales, IRI estimates its share is growing 10 to 15 times faster than total channel growth rates.

“Millennials are, perhaps unsurprisingly, the biggest adopters of e- and m-commerce, and their influence on the retail market continues to grow. An understanding of their buying habits is crucial; they tend to place ease and experience on a par with quality and value, and are more driven by product benefits than brand names,” Leathwood said.

“Retail marketers also need to factor in Gen Z, the generation behind them, who are constantly online and will continue to be so.”

Convenience is also crucial for the mobile younger generations as well as time-poor mid-lifers.

Consumers more focused, less loyal

Shoppers are browsing less. The popularity of click and collect has exploded, which can also reduce basket size because consumers are able to pick up their goods without wandering the aisles.

Ninety per cent of shoppers make lists before shopping, which makes the competition for influence on the path to purchase greater than ever.

Price, promotional mechanics and clever marketing is more influential than brand loyalty in FMCG purchases. This is opening up opportunities for smaller, more contemporary suppliers and brands, and more exclusive products.

“Grassroots marketing that brings a relatable, real-life authentic brand story to life has never been more crucial,” Leathwood said.

“Brands need to reflect consumers’ wants and needs, and those who don’t will be quickly dominated by those who get it right. It is no longer a case of the big eating the small, it is now a matter of the fast eating the slow.”

New technology trends

“We know FMCG suppliers and retailers analyse data, but many struggle to create value from it," Leatherwood added. "With the growth of data from the Internet of Things (IoT), the job to decipher it becomes ever-more complicated.

“Analysing disparate data from a variety of sources is a complex and overwhelming task for manufacturers and retailers. It is crucial they keep up to speed with new technology trends with a fresh mindset."

“If they master the data they will be able to achieve highly targeted and effective marketing strategies and a deep understanding of their customers.

Share the content