New research by IRI has revealed good-for-the-environment products, augmented reality and artificial intelligence are the retail trends that will appeal to customers in 2020.

Alistair Leathwood, Chief Commercial Officer, Asia Pacific, IRI, said: “2020 is going to be a year of significant technological innovation for fast-moving-consumer-goods (FMCG) retailers as many adopt and incorporate artificial intelligence and augmented reality into their engagement strategies to enhance and personalise the consumer shopping experience.

“Overall we identified the retail trends that will significantly shape the year ahead across Australia. While some are already evident, they will continue to grow in influence over the next 12 months and our research explains why.”

FMCG TRENDS

IRI’s latest research has found discounting to be the dominant retail trend in the groceries market increasingly dominated by food-based products as opposed to non-food. Despite a softening in economic conditions during 2019, major food and grocery retailers achieved sales growth.

“Woolworths grew sales by 3.3% for the year, beating out Coles which experienced a lower 3.1% growth in sales," Leathwood said. "Interestingly however, Coles had a far better first half year with 3.6% growth in sales compared to Woolworths 2.3%.”

Woolworths CEO Bradford Banducci admitted to having a “challenging start to the year”, but insisted that his company “had a strong second half and ended the year with good momentum.”

According to IRI’s research, growth in food sales are outperforming non-food sales despite starting from an even higher base.

“Where food and beverages grew by 2.4% over the past year, non-food sales grew by only 0.1% in the same period," Leathwood said. "Food and beverages now constitute 65.8% of the market compared to non-food, which constitutes 20.8% market share.

“Historically, supermarket grocery shoppers purchase most of their food and non-food items such as toilet paper and nappies in one shop. We are now seeing less non-food items going into the trolley. Discounting is also being used more commonly across both food and non-food items to drive sales.”

According to Leathwood, the growth of discounts and discounter stores is a key force in driving change in the UK and Australia. Coles and Woolworths have both utilised specific discounting techniques with great success.

“In the UK, we’ve seen discounters like ALDI and LIDL grow their market share year on year," Leathwood said. "The two companies control 14.1% of the UK grocery market, which is a major improvement on the past few years.

“Whereas ALDI controlled 5.6% of the UK market in 2015, they now control 8.1% of the market. The big four supermarkets in the UK have all seen their market share decline.

“Here in Australia, we’ve even seen Coles and Woolworths trying to compete with ALDI by offering more regular discounting schemes which carry far more advertising than before. Another way Coles and Woolworths have tried to compete with ALDI is through own-label brands, which now surpass 52% of unit sales.”

IRI’s insights also found that the big four grocery chains are focusing on developing and growing online platforms as another way of competing with discounters.

RETAIL TRENDS

According to IRI’s latest research, poor macroeconomic conditions have played a role in hampering retail growth figures. Economic growth is lowest since the GFC and consumer confidence is also low.

“Retail is often more affected by poor economic conditions than groceries," Leathwood said. "When times get tough, people’s retail spending is often the first thing to go. We all have to eat, after all.

“Total Australian retail growth clocked in at 3.1% for the year. Growth for FMCG was lower, at just 2.4% for the same period.

“When you break down retail into different industries, you can see some interesting trends. Whereas over-the-counter pharmacy grew by 1.2%, retail liquor grew by 3.1% in the same period. Petrol and convenience grew by 1.7% and packaged groceries experienced 2.4% growth.”

IRI research has also identified a number of retail trends and dynamics affecting the FMCG landscape, with most of them set to explode in 2020.

“Augmented Reality (AR) is set to play a larger role in the retail market," Leathwood said. "We’ve seen clothing brands use AR to let their customers try on their products without ever walking into a change room. Imagine seeing exactly what you look like wearing a shirt without actually wearing it!

“The technology could be used for hats, hair colours, make-up, glasses, shoes and even tattoos. With the technology already under development and being rolled out in some stores, it won’t be long before we see this type of capability across more retail outlets as brands embrace this type of in-store AR functionality.

“Artificial Intelligence could be used to automatically update price labels with just the press of the button. This could be a massive help to retail outlets struggling to compete in markets where discounting dominates and immediate price changes are essential.

“Australians are also early adopters of technology. We have seen this across the financial services sector. This is why we believe the incorporation of artificial intelligence and augmented reality into the shopper experience will resonate well with Australian households.

STAND-ALONE STORES

As premiumisation takes hold, there is potential for the major players to open more specialised stores.

Australia has already seen Dan Murphy's launch its first smaller-format store. Overseas, Rémy Cointreau believes selling premium spirits in the same way as Rolex watches and high fashion be the key to reaching more consumers.

The company has established Louis XIII Cognac boutiques in China and Europe, as well as a recent pop-up in Singapore.

“In the UK, we’re seeing Tesco open up a more upmarket store which stock their more luxury and premium products," Leathwood said.

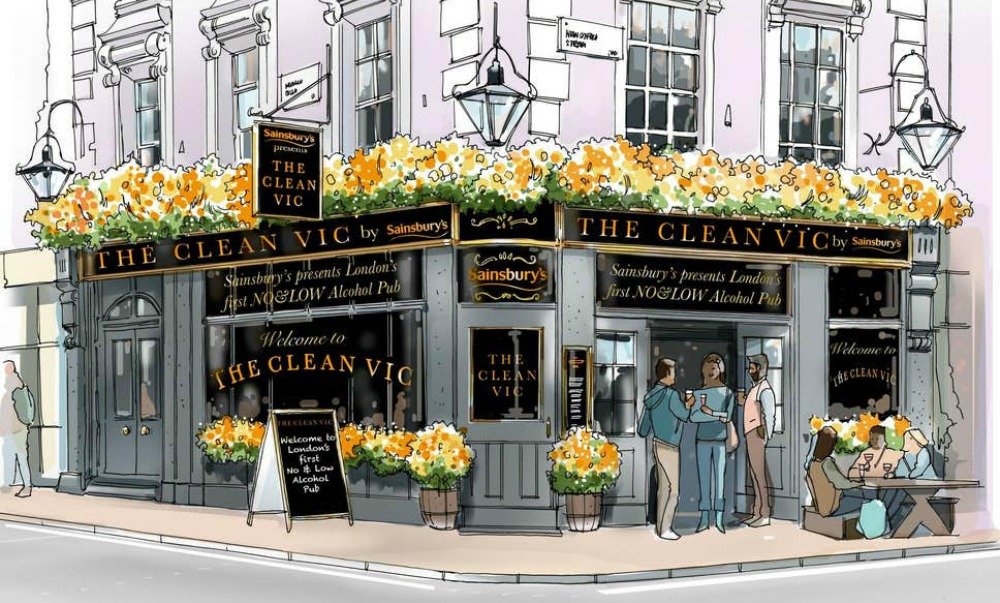

"Sainsbury’s have opened a non-alcoholic pub which showcases their non-alcoholic drink section. On top of that, Sainsbury’s have also opened a meat-free butcher. We could see Coles and Woolworths follow suit with their own unique, stand-alone ventures."

GOOD FOR ME, GOOD FOR THE PLANET

IRI research also shows that more and more shoppers are looking for products which are both ‘good for them’ and ‘good for the planet’. For a growing demographic of shopper, the two are inherently connected.

“Shoppers are increasingly looking for products that are, one, healthy for them and two, healthy for the environment," Leathwood said. "Any product that can fill these two criteria is well positioned to appeal to 2020’s health-conscious consumer.

“For example, Twinings Cold In’fuse tea is the perfect product that has capitalised on a number of consumer trends. It’s convenient, plastic-free, naturally flavoured and sugar-free.

“On the health side, foods high in sugar, dairy and salt are all being scrutinised by a growing demographic of shoppers. On the ethical side, shoppers are becoming warier of plastic packaging and carbon neutral production.

“In 2019, we saw a backlash to the Coles ‘Little Shop’ program, which was accused of using useless pieces of plastic. In the UK, Marks & Spencers created a similar program and faced backlash as well. Comparing the response to Coles’ ‘Little Shop’ with the response to Woolworths ‘Discovery Garden’ program reveals the growing trend toward ethical consumerism.”

FUNCTIONAL BENEFITS

“Our IRI insights have also shown us that if a manufacturer can sell their product as a source of good health, they’re one step ahead of the competition,” Leathwood said.

According to IRI research, 63% of Australians say their “diet is important to me” and 62% say “nutritional information displayed on products affects what I purchase.”

What shoppers define a healthy choice to be is important for retailers and manufacturers. The number one factor that health-conscious shoppers look for when looking for a ‘healthy choice’ are foods that are ‘free from artificial ingredients’.

“A massive 79% of shoppers defined foods ‘free from artificial ingredients’ as a healthy choice," Leathwood said. "Another 62% said foods ‘high in specific nutrients, vitamins or minerals’ constituted a healthy choice."

In order: free from artificial ingredients (79%), free from preservatives (73%), natural (71%), high in specific nutrients, vitamins or minerals (62%), organic (40%) and endorsed for a specific dietary plan (15%).

“Many areas of growth reflect the popularity of permissible indulgences," Leatherwood added. "Healthy protein bars are on the rise. Healthy chips like Grain Waves continue to innovate. Sugar-free ice cream is also becoming more popular. Kombucha has grown by 162% in the last two years. Kombucha is seen by many as a healthy alternative to soft drink.”

CONVENIENCE

According to IRI research, convenience will be a key selling point in 2020.

One of IRI’s key discoveries in 2019 has been the growth and extent of ‘convenient eating’ in the Australian food market.

IRI has found that one in five Australians are ‘under time pressure’ when shopping. The online food delivery industry is worth $2.6 billion each year and 28% of Australians are ‘interested or already buying’ online meal kits like YouFoodz and HelloFresh.

Coles has also tapped into this trend from a liquor perspective by exploring a relationship with Uber Eats that allows customers to choose from nearly 60 Liquorland products on the Uber Eats app, including beer and cider, wine, spirits, non-alcoholic drinks and snacks.

“Our research has revealed that Australians plan their meals less than ever," Leathwood said. "Convenience will undoubtedly be the name of the game for the grocery industry moving forward.

“IRI research has also found that half of Australians are interested in or already buying ready-made meals from supermarkets. Ready-made meals have the convenience of take-out, without the guilt.

"Interestingly, in response to our research, FMCG retailers are focusing heavily on these areas and you can already see more refrigeration shelves in supermarkets offering fresh ‘ready to go’ meals."

Share the content